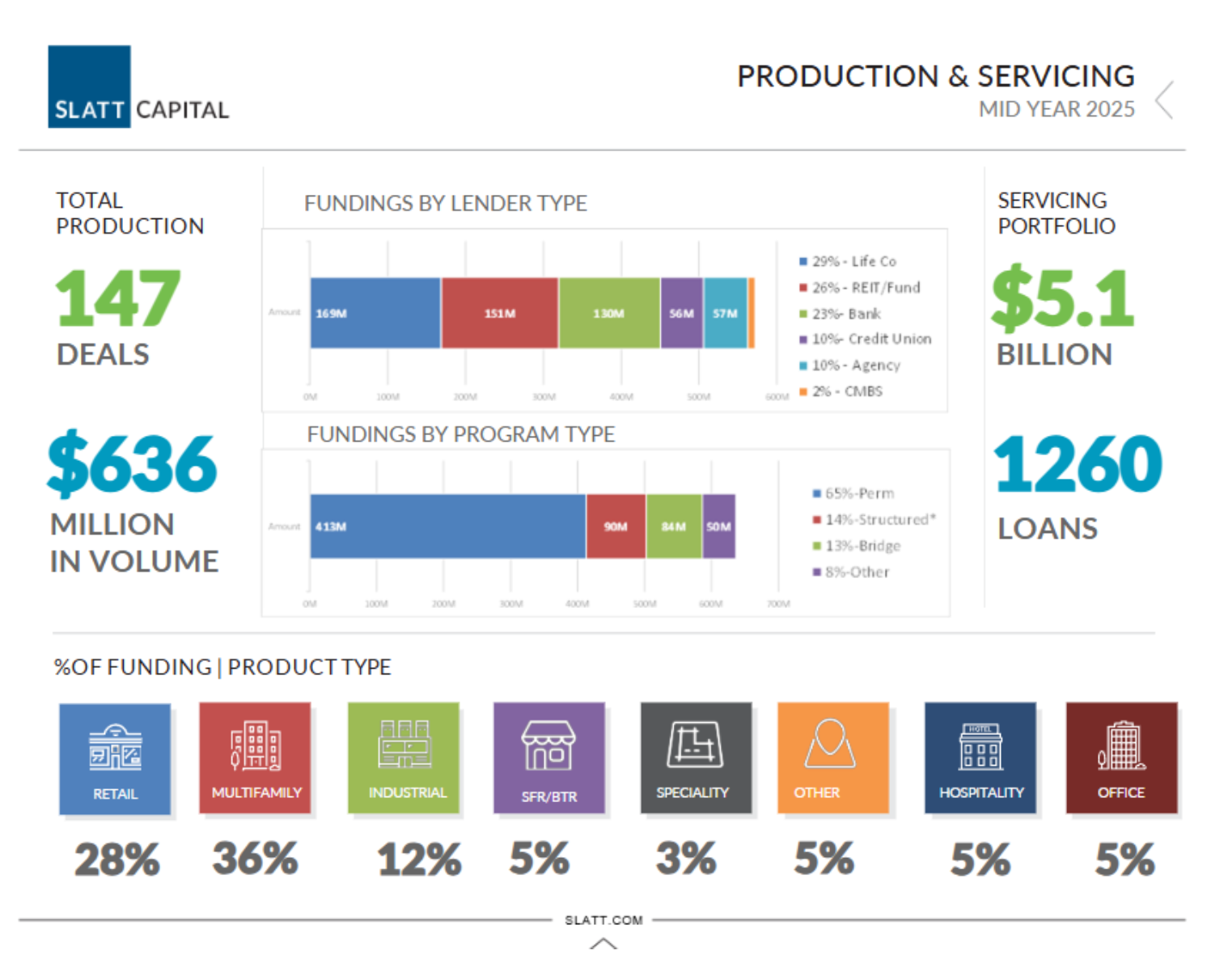

Slatt Capital, a national commercial mortgage banking firm known for its deep lender relationships and creative capital structuring, arranged more than $636 million in financings across 147 transactions during the first half of 2025. Driving the activity were strong showings in multifamily, retail and industrial, the top three asset classes by volume and making up more than 76% of the total transaction value.

Unsurprisingly, multifamily transactions led all sectors in valuation, at $207 million. Despite softness in some key markets, the lack of available housing in many markets continues to drive investment across the lender landscape. Slatt Capital closed transactions for a mix of ground-up development, refinancing, and affordable housing projects. Highlights included a $27.5M refinance of a 270-unit community in Texas and a couple of Fannie Mae delegated underwriting and servicing (DUS) deals in Indiana, a $22.8 million refinance of a 324-unit community and a $9.3 million cashout refinance. These transactions highlight Slatt’s ability to align capital solutions with housing needs in both high-growth and supply-constrained markets.

While leading the way in transaction volume in H1 2025, the resilient retail market accounted for more than $162 million in closed loan value. Lenders and investors continued to favor necessity-driven, and grocery-anchored properties. Noteworthy transactions included a $19.7 million refinance for a two-building grocery-anchored shopping center in San Jose, CA, a $13 million acquisition of a multi-tenant retail center in Auburn, CA and a $11.7 million refinance of a grocery-anchored retail center in Mill Valley, CA. Across the retail total, Slatt arranged a mix of acquisition, refinance, construction and bridge loans, showcasing the breadth of its execution across varied loan profiles.

Industrial financing totaled approximately $66.3 million, representing 12% of the firm’s midyear transaction value, reinforcing Slatt Capital’s strong presence in logistics and supply chain infrastructure. Among the largest transactions were a $14.3 million construction loan for a 97,000-square-foot flex industrial facility in Oregon, a $7.5 million refinance of a 123,000-square-foot multi-tenant industrial center in California, and a

$6.6 million construction loan for a multi-tenant industrial property in Texas. The firm’s reach extended to flex and cold storage assets as well, rounding out a high-demand category with tailored financing strategies.

Additional Highlights

While the top three sectors drove most of the activity, Slatt also delivered notable transactions in hospitality (~$30.4 million), office (~$29.2 million), and mixed-use ($22.2 million), including branded hotel development and energy-efficient multifamily retrofits.

As for the most active lenders in the first half of the year, banks and credit unions led the way at 33% of the total, followed quickly by life insurance companies at 29%, REITs/funds at 26%, agency at 10%, and CMBS at 2%.

“As market cycles shift, the need for nuanced, relationship-driven capital solutions grows stronger,” Kaplan added. “Our midyear track record shows that sponsors trust Slatt Capital to structure competitive, tailored financing across the capital stack.”

About Slatt Capital

Slatt Capital is a long-standing, respected institution with 55 years of experience in commercial mortgage banking. It has correspondent relationships with several of the country’s most prestigious capital sources, providing custom-tailored solutions for sponsors’ needs. In addition to assisting clients with debt and equity placement nationwide, Slatt Capital manages a $5+ billion servicing portfolio. To learn more, visit us at www.slatt.com or follow us on LinkedIn.

Feature Image Courtesy of: Slatt Capital

View the original article and our Inspiration here

Leave a Reply