CoworkingCafe’s latest quarterly report on the coworking industry leverages proprietary data as of July 2025. In this study, we break down coworking space stock availability across the 50 largest markets, along with their size and distribution, subscription prices and top coworking operators.

National U.S. coworking location count dips for the first time in the post-COVID era, signaling a cooling national footprint and a more measured approach to growth, while total square footage expansion slowed dramatically to just 0.3%, compared to the 3% from the previous quarter. Geographically, the data paints a nuanced picture of growth and contraction.

Here are more details on how the coworking market performed in Q2 2025:

- Less Inventory: The Atlanta market had 14 less coworking spaces by the end of Q2 2025 — reaching 233 — representing a 6% decrease Q-o-Q.

- Square Footage Decrease: Atlanta stood at precisely 4.73M sq. ft. at the end of Q2, a 2% decrease Q-o-Q.

- More Average Square Footage: the average square footage increased by 4% Q-o-Q, from 19,534 sq. ft. in Q1 to 20,299 sq. ft. in Q2.

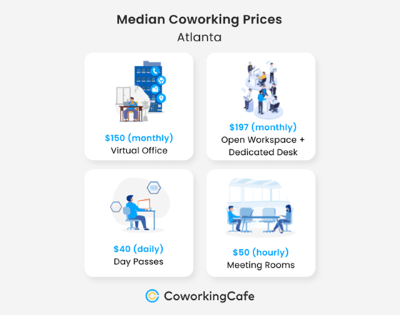

- Pricing*: Virtual offices were $150/month at the end of Q2, slightly below the national level sitting at $159. Meeting rooms sat at $50/hour, above the national level of $45, while a day pass had a median cost of $40, above the national median rate at $30. Memberships were $197/month, below the national median at $225.

You can read the full industry report here: https://www.coworkingcafe.com/blog/national-coworking-report/

For better context, you can also check out our State of the Industry Report Q1 2025.

Atlanta market overview:

Median pricing:

- virtual offices stood at $150 at the end of Q2 – national median $159

- meeting rooms stood at $50 at the end of Q2 – national median $45

- day passes stood at $40 at the end of Q2 – national median $30

- memberships stood at $197 at the end of Q2 – national median $225

Number of coworking spaces:

- dropped by 6% Q-o-Q to 233 spaces from 247

Total square footage:

- dropped by 2% Q-o-Q to 4.73 million sq. ft. from 4.82 million sq. ft. in Q1

Average square footage per location:

- increased by 4% Q-o-Q to 20,299 sq. ft. from 19,534 sq. ft. in Q1

Feature Image Courtesy of: Coworking Cafe

View the original article and our Inspiration here

Leave a Reply