Chris Coleman is partner-in-charge of St. Louis-based accounting firm RubinBrown’s Construction Services Group. Opinions are the author’s own.

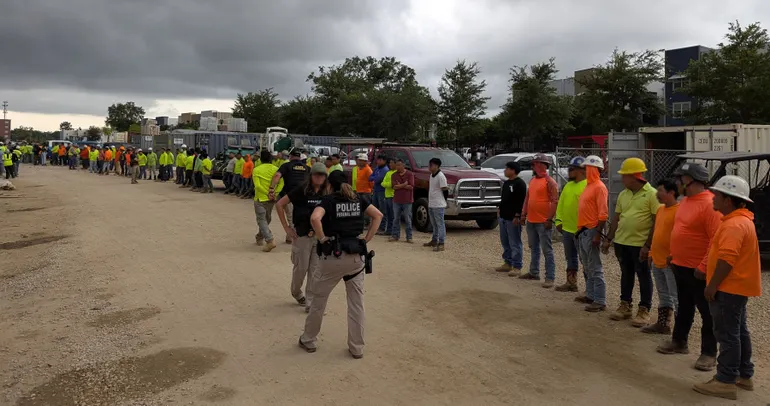

In an already tight construction labor market, raids by U.S. Immigration and Customs Enforcement at jobsites threaten to deepen workforce shortages, drive up costs and create serious financial risks for contractors. In dealing with the fallout of these raids, construction companies will have to rethink their talent strategy to succeed.

Chris Coleman

Courtesy of RubinBrown

The U.S. construction industry has faced chronic labor shortages for decades, with a shortfall of 439,000 workers. Immigrant workers have helped close the gap and now make up a considerable part of the workforce.

Nationally, an estimated 19% of all workers are foreign-born, according to the Bureau of Labor Statistics. But in construction, 34% of workers are immigrants, the National Association of Home Builders reports. In some trades — think drywall installers or plasterers — that number skyrockets to over 60%.

Given those numbers, construction projects have become a popular target for immigration raids. Construction owners are rightly concerned; reports of indiscriminate arrests and detainments are creating an environment of fear at job sites, even among legal workers and citizens.

While several industry groups have lobbied the Trump administration to take a more nuanced approach to immigration enforcement, construction companies have to respond now, managing their projects with a smaller and potentially less reliable workforce.

Steps for contractors

The simplest thing companies can do is to audit themselves to ensure that employment verification and I-9 processes have been properly followed. Managers and leadership should also be adequately trained on the law.

But even then, these raids will still happen. When they do, they’re going to cost companies time and money on projects that have long been budgeted out. To avoid exposure to potential contract penalties, construction companies need alternative labor they can turn to in a pinch.

In the short term, construction companies can lean on local industry groups to quickly source workers. So long as these relationships have been cultivated, a labor union, a merit group, an industry association or specialty trade organization can offer direct connection to the skilled laborers these projects need. Similarly, a contractor may opt to sub out work instead of self-perform to avoid labor challenges.

While third-party labor groups can be valuable sources of skilled talent, they are not a comprehensive solution for every project. Accordingly, it is essential to invest in building a more resilient internal workforce — one characterized by higher retention and greater operational flexibility. In light of ongoing volatility in the construction labor market, strategic investments in cross-training initiatives for the employees you already have offer meaningful long-term value.

These programs enable employees to acquire complementary skill sets through on-the-job learning, thereby enhancing workforce agility and reducing reliance on specialized labor. A cross-trained workforce can be deployed more efficiently across various phases of a project, ensuring continuity and minimizing productivity loss in the face of turnover or unexpected disruptions.

Pay for it

The other option is, of course, spending more money.

It’s something many stakeholders don’t want to hear, but as the market tightens, owners are finding themselves paying more for talent, even eating those costs to ensure project timelines stay on track. It’s an offensive play as much as it’s a defensive one: In an industry where talented craftspeople regularly get poached by competitors, paying above-market premiums may be the only solution companies have to solidify their talent bench.

The risk for construction firms is that paying more reduces the margins they’re expecting on a given project, something that can have serious consequences to the overall health of a company. A disruption on one project creates a cascading effect for a company’s future projects and can seriously damage a company’s reputation.

Negotiate with owners

As much as a strong, diverse labor pool can mitigate these issues, if the contract price for projects doesn’t cover the cost of last-minute labor overages, the bottom line is going to suffer no matter what. Given the realities of the current marketplace, it’s worth pursuing favorable contract terms so that these unexpected labor premiums are covered.

Getting fully-flexible labor costs built into a contract is unlikely, but partial cost-plus provisions can help cover some of the labor costs that companies are facing. Because these contracts are based on forecasts happening months in advance, they are critical to limiting cost exposures.

Workforce issues are nothing new for construction companies, but the uncertainty that ICE raids are causing creates fresh urgency for businesses to find solutions. Labor is a fundamental building block of construction, and it needs to be a building block of company strategy, too.

View the original article and our Inspiration here

Leave a Reply