The built environment startup arena is still buzzing, but the way money is flowing is definitely changing. According to the latest BuiltWorlds 2024 Venture & Investments Report, venture capital (VC) deal volume is up, but the total amount of cash coming in has dropped. In other words, investors are still writing checks, just smaller ones and to more companies.

VC Funding: Back to Reality?

After a wild few years of economic swings and big government stimulus packages, investment in the built environment seems to be settling into something more stable. The report notes, “The built environment venture capital markets rebounded after two consecutive quarters of repressed activity. This unique phenomenon was driven by a normalization in the average venture capital round.”

That “normalization” shows up in the numbers. The average VC round in 2023 was $34.5 million—that’s dropped to $25.2 million in 2024. Why? Some of it comes down to a handful of massive deals in late 2023 that skewed the numbers. But overall, it looks like investors are being more careful, spreading their bets, and focusing on quality rather than just throwing money at big ideas.

BuiltWorlds’ Tyler Sewall puts it this way: “It is possible that for the first time since 2019, investment decisions were not significantly driven in some way by macroeconomic impacts.” In short, investors are getting back to basics—betting on real tech and solid business models instead of reacting to external factors.

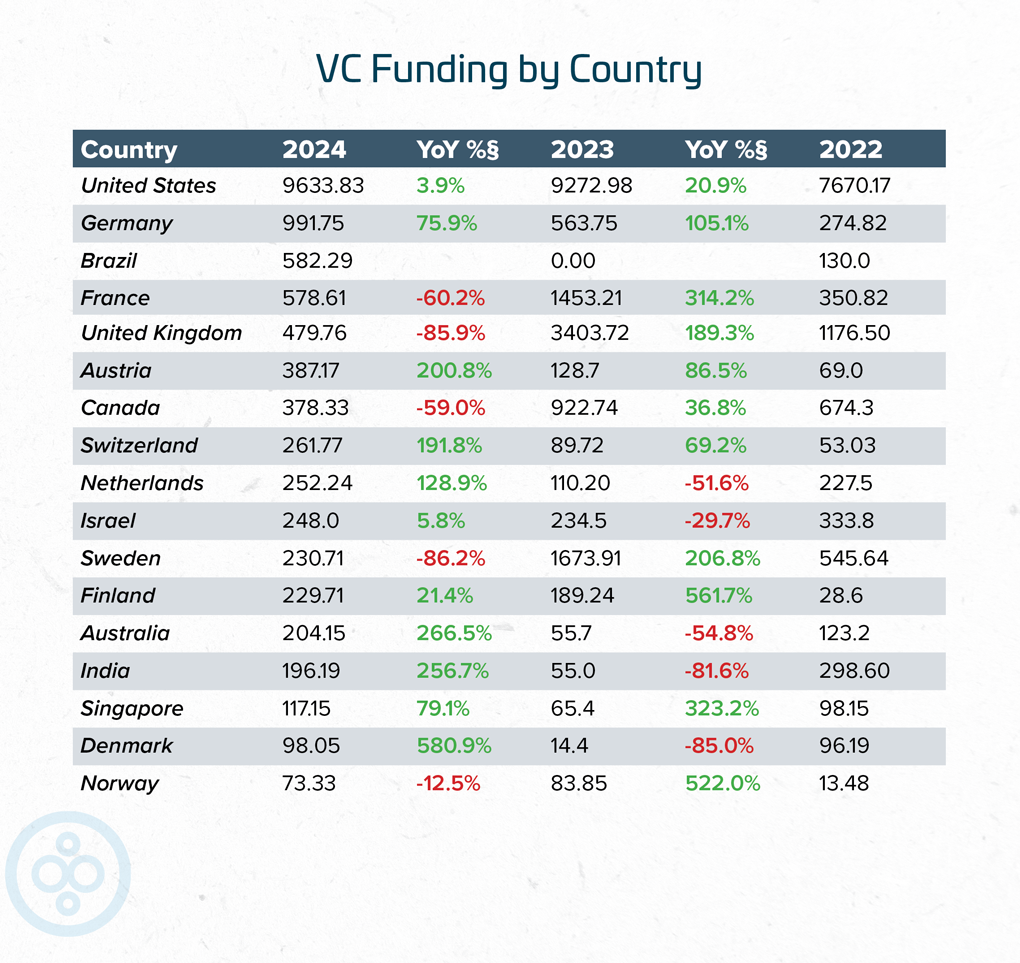

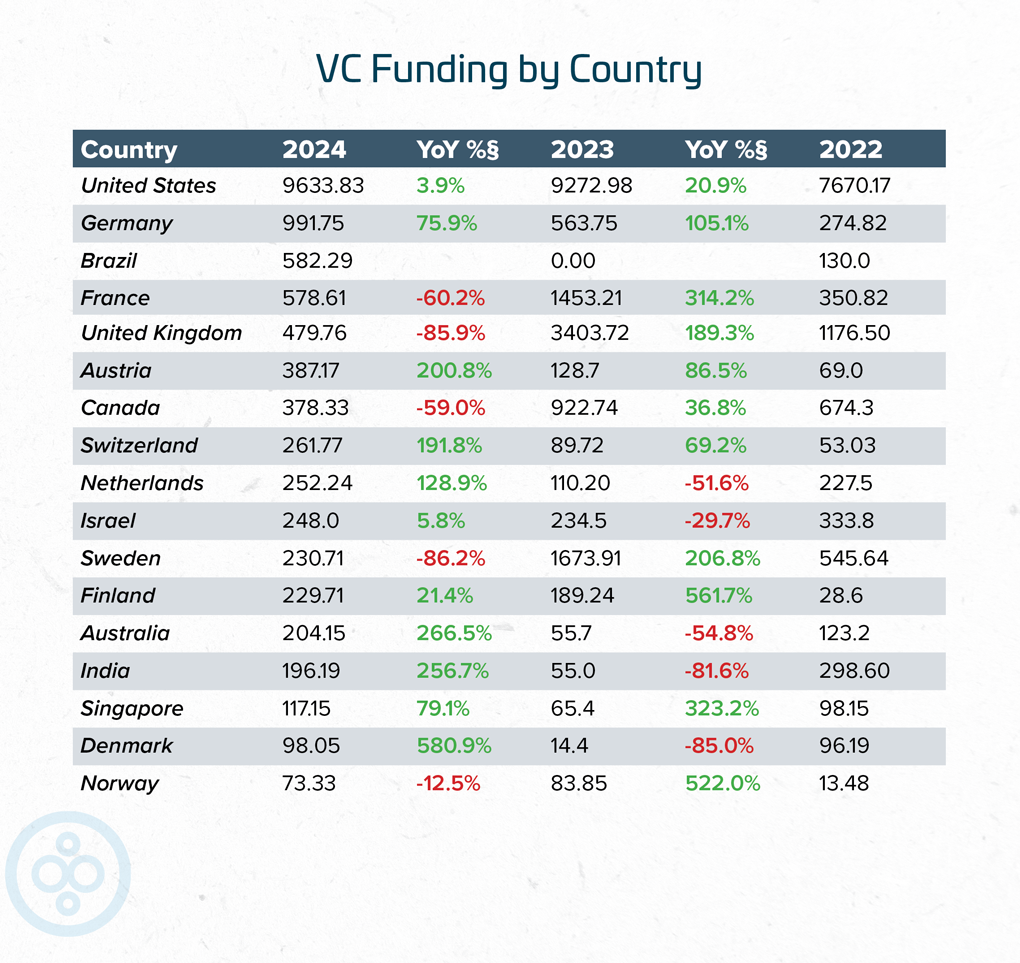

Who’s Getting the Money? Europe’s on Fire, UK Not So Much

Some parts of the world are seeing huge surges in funding, while others are slowing down. One of the biggest winners? Central Europe, especially the DACH region (Germany, Austria, and Switzerland), which saw a 109.8% year-over-year increase in VC funding. That’s on top of a nearly 100% increase the year before! What’s driving it? The region is becoming a hotbed for climate tech and modular construction startups, both of which are gaining serious traction as cities scramble to build more sustainable housing.

On the flip side, VC funding in the UK dropped a staggering 86% year over year. Rising interest rates, economic uncertainty, and stricter regulations have made it a tough environment for investors, particularly smaller firms. Sewall points out that compliance costs have been climbing, and capital gains tax increases have made it harder for founders to cash out, which in turn makes investing less attractive. Not great news for startups looking for funding there.

Infrastructure & Building Tech Still Dominate, But Construction Tech is Catching Up

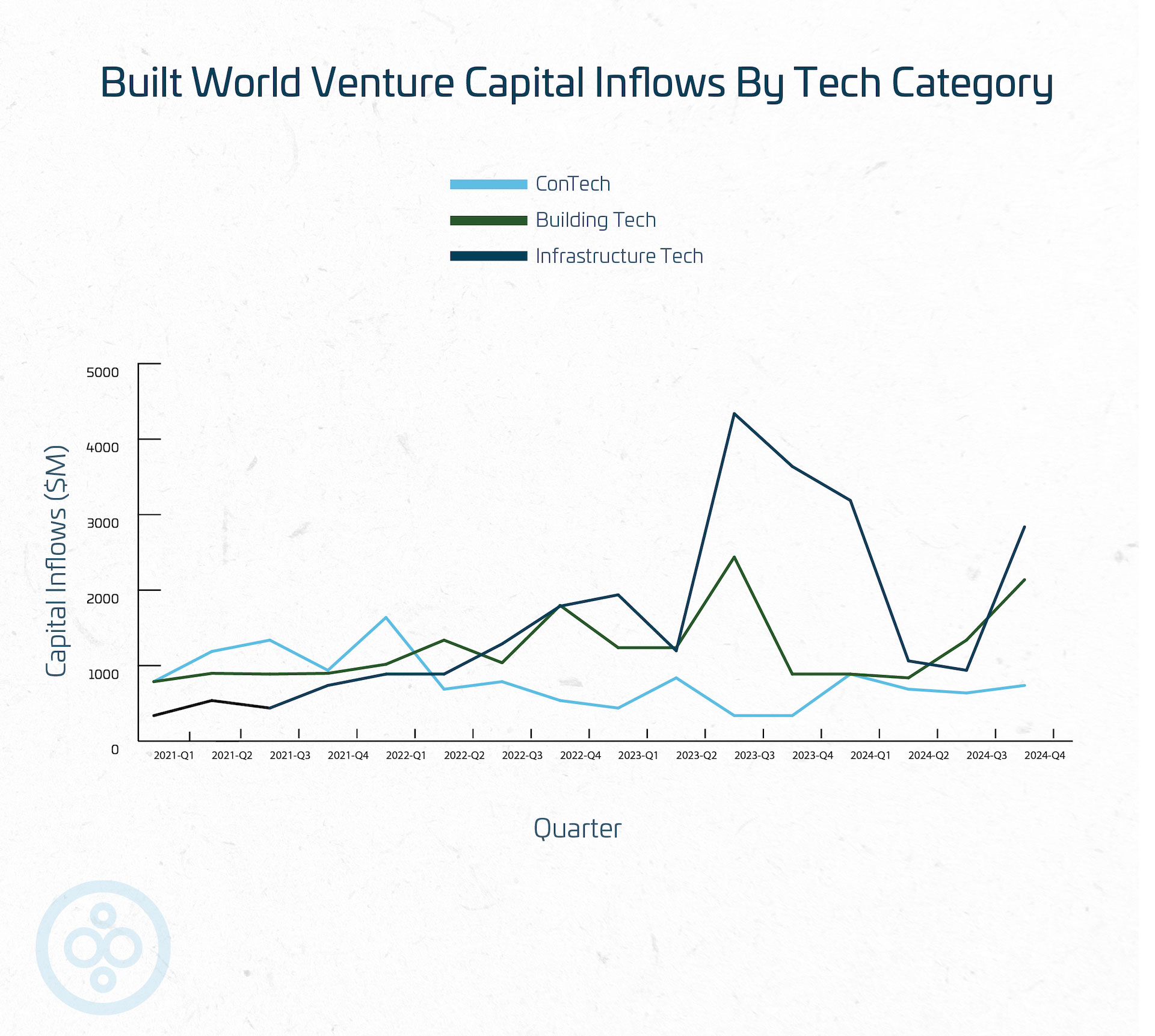

The built environment’s VC money is still mostly flowing into infrastructure tech and building tech, but construction tech is the only category that actually saw growth in investment inflows this year.

Infrastructure tech is an interesting case. Even though inflows dropped from $11.9 billion in 2023 to $7.9 billion in 2024, the number of deals actually went up slightly, from 215 to 217. So, what’s happening? A lot of this money is still tied to the Bipartisan Infrastructure Law (BIL) and the Inflation Reduction Act (IRA) in the U.S., which have pumped cash into grid-scale energy transition startups and tech-enabled utilities. That said, with President Trump reportedly looking to pause some of this funding, there’s a bit of uncertainty about how long this will last.

Sewall isn’t hitting the panic button just yet. “A larger factor that is always at play is interest rates, which remain high as inflation numbers remain elevated. This will ultimately play a key role into 2025 and beyond.” Translation: keep an eye on what the Fed does next.

Meanwhile, building tech saw a jump in deals from 196 in 2023 to 247 in 2024, even though overall inflows dropped slightly from $5.6 billion to $4.8 billion. So, what’s driving that? AI-powered design tools, smarter space utilization solutions, and big improvements in prefab and modular construction. It looks like architects, engineers, and developers are doubling down on efficiency and sustainability—two areas where tech can make a huge impact.

What’s Next?

If you want to dig deeper into these trends, BuiltWorlds’ upcoming Venture West event in San Francisco (April 8-10) will bring together top investors and innovators to break it all down.

One thing’s for sure: while the built environment startup world isn’t seeing the crazy cash infusions of a couple of years ago, the money is still there—it’s just being invested more thoughtfully. Investors are looking for solid business models, real technological advancements, and sustainable solutions. That’s good news for the long-term health of the industry. The next few years will be all about who can execute, who can scale, and who can actually deliver on the promise of innovation.

You can download the report if you’re a BuiltWorlds member.

Source: BuiltWorlds, Chicago, IL, February 25, 2025

View the original article and our Inspiration here

Leave a Reply