A new study from the University of Sydney’s School of Engineering analyzes how digital tools shape construction practices in Australia. The research examined how three tiers of companies and various roles within those companies see the present and future of emerging technologies.

An observation that stands out is that the smallest companies rate the importance of new technology much lower than the larger ones.

How they studied

The researchers gathered insights from 8 expert interviews and 66 survey respondents. The number of experts reached is moderate, so the results offer meaningful insights rather than a definitive overall picture of the Australian industry.

The research focused on seven emerging technologies: BIM, AI, digital twins, VR, AR, UAVs (drones), and sensor-related technologies. These were identified in previous research as having the most potential to improve cost, safety, quality, and efficiency in construction.

The researchers divided the responses based on the “tier” of the company. It’s a classification used in Australia.

Tier 1 firms are the largest, with a substantial balance sheet, and can assume project risk. Tier 2 contractors are construction companies that rely on subcontractors to perform much of the work. Their contracts range from $50m to $300m. A Tier 3 contractor relies heavily on subcontractors and usually only performs minor work on contracts of around $1 million, up to about $50 million. The study also included some boutique engineers.

How firms differ in tech adoption

The study weighted responses based on the participants’ industry tiers and roles. Some roles influence decision-making and technology adoption more, so their word weighed the most.

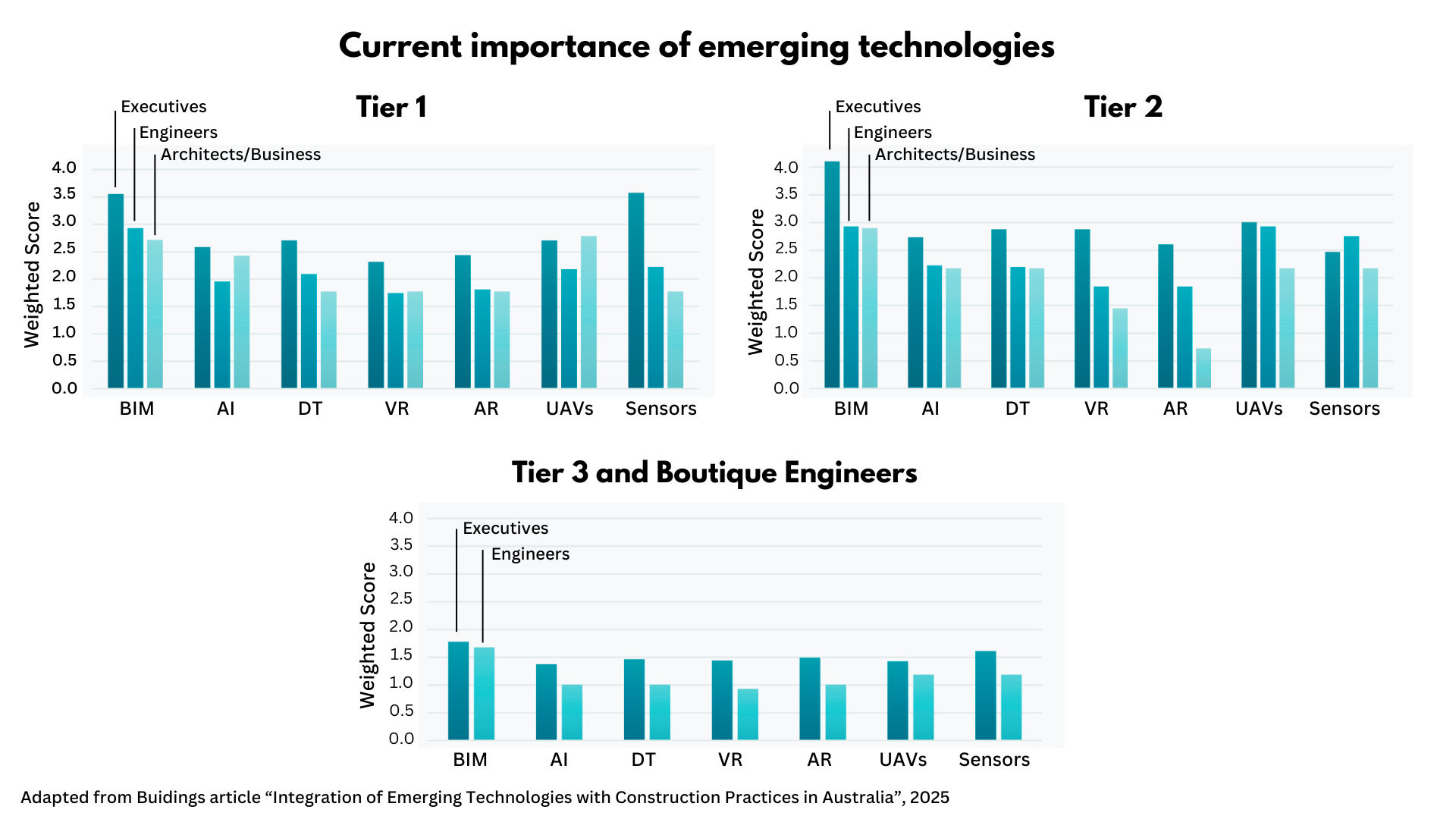

The analysis shows that Tier 1 firms are the most advanced in tech adoption. For them, sensors, BIM, UAVs, and digital twins are the most critical emerging technologies. They are also looking for AI applications for proactive analysis.

Tier 2 firms value BIM the most, but UAVs and sensors are also essential. Interestingly, the executives in both tiers are more optimistic about the importance of technology than engineers or architects. Maybe CEOs and other leaders are more future-oriented and less concerned about everyday technological challenges.

Tier 3 firms see emerging technologies as less critical than the first two. Tier 3 executives rank most emerging technologies under 1.5 on a scale from zero to five, whereas Tier 1 and 2 rate most of them between 2.5 and 4.2.

All companies regard BIM as the most pivotal emerging technology in construction projects. Sensors and UAVs are popular because they are inexpensive and provide immediate benefits. Virtual Reality and Augmented Reality are the least essential for the surveyed companies.

All Tier 2 industry professionals ranked AI as the most or second most effective technology for reducing costs, while Tier 3 professionals placed it third.

In Tier 1 firms, Executives and Architects considered AI the technology of most significant importance for reducing costs after BIM, whereas Engineers ranked it among the bottom three.

The barriers to the integration of emerging tech

The survey analyzed six obstacles to the adoption of emerging technology.

Six of the eight interviewees found cost a significant barrier, and the survey also emphasized the same.

Training is another substantial hindrance. One interviewee explained that the current state of training within the construction industry is often “ad hoc,” where “a lot of my staff will go off and figure out what they need to learn in very small chunks [and] they learn from each other.”

Over-confidence in technology is also a common concern. “Just because it’s a really sexy looking digital model and it’s in colour, and you can manipulate it and all that kind of stuff, that doesn’t actually mean it’s right,” as one interviewee stated.

The tech imbalance

The study made me aware of a critical problem in construction technology: the tech divide.

Construction is a networked industry in which tier 1, 2, and 3 companies and boutique firms collaborate to carry out projects. If the gap between the advanced companies and those lagging in tech adoption becomes wide, technology becomes a divider, not a unifier.

It is not just about tech investments; it’s about how companies can share information and data.

For example, if you can’t trust the information you receive or cannot technically use it, you must recreate, recalculate, and redistribute it. This is a lot of unnecessary work and potentially a source of errors. Also, a lot of data gets neglected because it’s never shared.

How to start closing the tech divide

As the industry continues collaborating with various firms and configurations, it is essential to lower the barriers to technology adoption for all. Otherwise, the benefits of using a specific technology will not be realized.

A known challenge is that companies that invest in new technology don’t necessarily benefit from it themselves directly, so there’s little incentive to do it. On the other hand, if a client or CG would compensate for upskilling and tech implementation in a specific project, there may not be enough time to catch up.

The best results in closing the tech gap come from long-term collaboration between CGs and trade partners. When the participants see their work getting less risky, predictable, and productive, they’re willing to invest in tech and training.

Software developers should do their part as well. AEC software, rooted in the 1990s, doesn’t necessarily meet modern users’ expectations.

Perhaps AI and startups that look at the industry with fresh eyes will come to the rescue.

You can download the report I discussed and contact the authors of “Current importance of emerging technologies in Australian construction firms” at https://www.mdpi.com/2075-5309/15/3/396.

View the original article and our Inspiration here

Leave a Reply